Etail Canada took place from May 16-19 in Toronto, bringing together top retailers in Canada, as well as some of the brightest Digital Marketing and Ecommerce leaders in the field. It was the 5th edition of the Etail Canada event, part of the WBR events series, and was one of the best.

I have the pleasure of being on the Etail Canada Board of Advisors. I also had the pleasure of being asked to speak on Day 1 of the event, and be the Chairperson for Day 2.

The name of my talk was Tell a Story, Then Grow – Twitter-worthy Stats and Benchmarks. It detailed some industry benchmarks where retailers should be in their digital journey, with many of the statistics focused on Canada.

I thought it would be useful to highlight the 5 key slides from my presentation, especially for those that could not attend.

5 Key Notes From My Etail Canada Session

1. Digital Marketing Spend in 2015

Probably one of the more useful takeaways from my Etail Canada talk was the topic on Digital Marketing spend. We all want to know where we stand in relation to other retailers’ spend. And these benchmarks from Listrak help us do just that. So this may look slightly different than how you may be spending on your Digital Marketing channels, but on average, retailers are spending over half their budgets on Search Engine Optimization and Search Engine Marketing. Talking to peers, this is actually quite accurate, give or take a few percentage points. The next largest channels in terms of spend are Email (14% of budget), Social (12%), and Affiliate (11%). Surprisingly, Mobile is only at 5%. Expect that number to grow significantly in the next 12-24 months.

I guess the point to take away from this data is if you are drastically over or under spending in one of these channels compared to the benchmarks, maybe you want to have another look at your spend levels.

Some more good news for digital marketers: eMarketer estimated an increase of 17% in 2015 digital marketing spending levels over 2014, so you should be seeing a growth in your digital spend. So ask yourself: did your 2016 digital spend grow by at least 17%? According to the benchmarks, it should have.

2. Mobile Commerce: The Rising Superstar

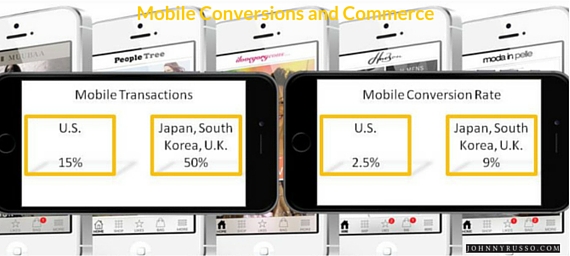

Still on the topic of mobile, don’t feel too bad, mobile conversions are a struggle in many places. But nowhere is there a better story of mobile’s success than in Asia.

When it comes to Mcommerce, the U.S. is actually not a global benchmark. According to Soasta, in the U.S., currently only about 15% of online transactions take place via mobile devices. In Japan, South Korea, and even the UK, that number is approaching – or in Japan’s case – exceeding 50%.

Mobile commerce conversion rates are climbing as well. Again, we can look to Japan for an idea of where this trajectory is headed for North American shoppers. Currently, mobile shopping in the U.S. has an average conversion rate of almost 2.5%. In Japan, the average mobile conversion rate is more than 9%. The U.S. will catch up here, and that will trickle slowly down into the Canadian market, where mobile conversion rate for the most part is below 1%.

And if we don’t think mobile will turn into a transactional channel, we’d be wrong. According to ABI Research, Mobile commerce will account for 24% of overall Ecommerce revenues by the end of 2017.

And if you think of Ecommerce growth vs Mobile Commerce, we are simply at the beginning of this Mobile Commerce disruption. According to comScore, Ecommerce as a whole is growing at 11%, but Mobile Commerce is growing at 47%.

Mobile shopping adoption has been lagging, but it seems to be on the verge of breaking through.

3. Digital Influence on Shopping…Up, Up, and Away!

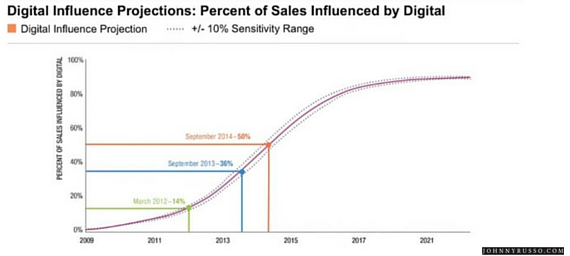

While traditional marketers will tell you that traditional media still plays a role in shopping research and influence, it can’t be argued that the pendulum is indeed swinging over to digital, and if they don’t join, they’ll be hit by it.

Scott Galloway, an NYU Marketing Professor and retail guru, gave a great talk called The Death of Pure Play Retail. In it, he mentioned that digital influence on shopping behaviour is currently at about 50%. In 2017, that is forecast to be 80%. Think about that. If your budgets and time spent preparing for this are not following that trend, your brand may not survive. You must fight for that shift to occur with your brand. You may need to change mind set and culture, but the research is there to support it.

As technology continues to advance, it has been equally influential in changing the way consumers are shopping – before, during, and after store or online visits.

4. Conversion Rate is a Silo Metric for Multi-Channel Retailers

Should I repeat that? Yes. Ecommerce conversion rate has become a silo metric for multi-channel retailers. Why? This probably warrants a full blog post on this topic, but many retailers with brick and mortar stores not only use their websites for online transactions, they use it as a drive-to-store vehicle or research (product, store hours, price, etc.) avenue. So in short, lots of that traffic is not there to convert online, but they are interested in visiting a physical store and shopping there.

2.5% is the average conversion rate for the Internet Retailer Top 500 (mostly made up of U.S. companies).

Now, if I ask many of you reading this in 2016, if you’re hitting that, the answer is likely no. And that’s ok, because this number is mostly U.S.-based and also includes pure play.

So is conversion rate as we know it outdated as a main KPI for multi-channel retailers? Interesting debate and I think the answer is yes. Is attribution a more important metric for the future of retail? It may just be. So how does digital influence in-store sales and traffic and vice versa? As we saw above, digital has about a 50% influence on in-store traffic. That’s a good business case for more Omni-Channel or Digital dollars.

The future of retail is measuring the contribution that one experience or channel has on the next experience, whether or not the customer converts in the original channel.

5. Ecommerce Employee Growth: 27% Year Over Year Since 2012

If you’ve ever asked for headcount, the image above generally depicts how it goes with HR. I know I’ve been hit with my fair share of chairs. While it should be, hiring before we need to is not always an option, especially in retail. And while those of us in this industry may know of the digital growth taking place, your HR teams may not. So it’s important to educate them and senior management on the shifts in budget, increases in online traffic and sales, and the complexity of this industry.

According to the Internet Retail Top 500 Guide year-over- year growth of Ecommerce employees since 2012 is about 27%. So if you are a team of 4, did your team grow by 1 team member? If you have a team of 10, did you plan for 3 additional people? If you’re team is 25 people, you should be hiring about 7 people. Other retailers who are your competitors are doing just that.

We often take for granted that our bosses and our senior leadership teams know the exact nature of the digital disruption that is taking place. But we are in the thick of this digital disruption, they are not always privy to some of the info we have. So we are seeing shifts possible before some senior leaders or traditional marketers or brands recognize them. It’s our job to tell them why we need to adapt; it’s not their job to tell us. That’s why they hired us!

Are any of the benchmarks listed above totally different than what you’re seeing? Which ones are on track with what you’ve seen in the last 12-18 months?

Leave a Reply